MIP TRICK OF THE MONTH

1099-NEC Changes for 2020

Question: Starting 1/1/2020 Information that was previously coded to Misc 1099 Box 7 is now supposed to be coded to a 1099-NEC form. How is this done in MIP?

Answer: The government changed the rules regarding non-employee compensation starting 1/1/2020. Previously these amounts were coded to the 1099-MISC form in Box 7. Now they will be coded to a box on the new 1099-NEC form.

Prior to version 2020.2 it was not possible to code anything to the 1099-NEC form. It was

advised to continue to code items to the MISC-07 box as in the past.

After upgrading to 2020.2 it will be possible to code items to the 1099-NEC form. To make this happen and to get the historical data correct several things need to be done.

These include:

- Changing vendor defaults to the new box

- Making sure to use the new box in transaction entry

- Moving historical information from MISC-07 to the NEC via 1099 Adjustments.

Part 1 – Changing Vendor Defaults to the New Box

For most customers the process of entering 1099 information is somewhat automated. When a vendor is set up as a 1099 vendor, they are assigned a default 1099 box information. This was usually MISC and Box 07. The MIP upgrade process is not going to automatically change these default values. It is up to the customer to update their vendor information.

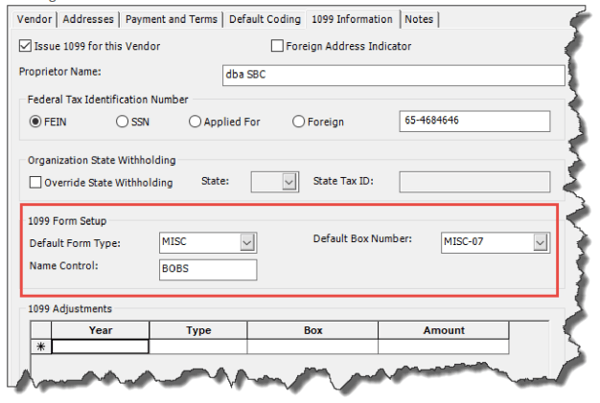

To do this go to Maintain>Vendors. Pull up the 1099 Vendor and go to the 1099 Tab. It will look something like this:

Pay attention to the 1099 Form setup section.

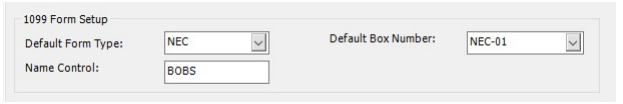

On this section you will click the Default Form type and change it to NEC and the default boxnumber to what is desired (usually NEC-01).

Click Save and this will save the changes.

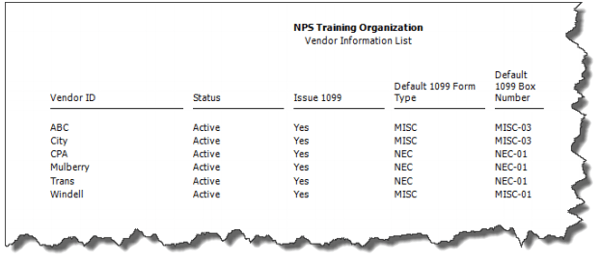

Q: Is there a way to determine which vendors need to be updated?

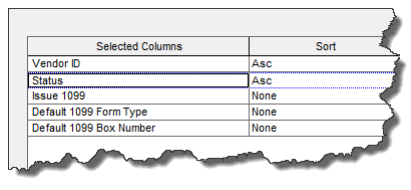

A: Yes. You can run a vendor report. Go to Reports>Accounts Payable>Vendor Information.

Create a New Report, and on the Content Tab add the following columns:

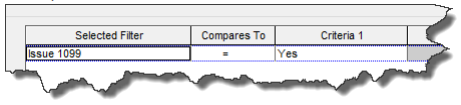

On the filter Tab filter for Issue 1099 = Yes. You may also wish to filter on Status = Active.

Print this report and you will see a list of vendors and their Form Type and Box Number.

After you have updated all your vendors then going forward you are ready to use the new 1099 Values.

Q: I have a lot of vendors is it possible to do a mass update of vendor information and changethe default values to the new box?

A: Doing a mass update of the vendors is not possible through the user interface. Mass updates can be done via an Import or through a SQL script. You can contract Soft Trac

support@softtrac.com for assistance for this Professional Data Service.

Part 2 – Using the New Information

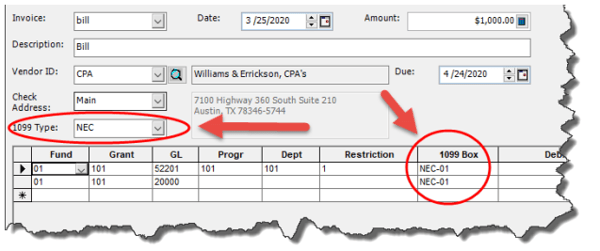

Once you have updated your vendor information you can use the new values when doing data entry.

When you create a document that might have 1099 information on it the 1099-Type Box will

pull up the “NEC” value automatically. When you do lines of transaction entry check the 1099-Box Column and make sure it has the correct value.

MIP has a checking feature built into it.

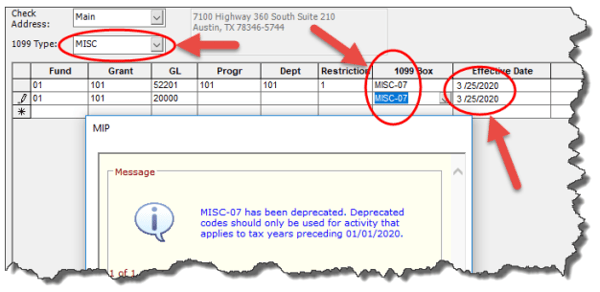

If you attempt to use a 1099-MISC Box 07 on a transaction with a 1/1/2020 effective date or

later you will get a warning that it should not be used.

You should change the 1099 Type to NEC and choose the right box.

If you ignore the warning the system will eventually allow you to save the document, but you will need to correct it when doing your 1099’s. This may become an issue if you are reversing or correcting a mistake for 2019 in 2020.

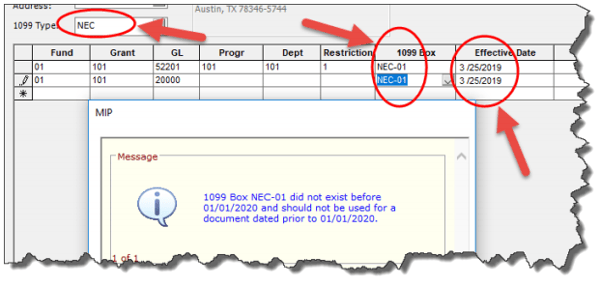

Also if you attempt to use the new NEC values in a transaction with a 2019 effective date you will also get a warning.

You should not be using NEC values in 2019. You should change the 1099 Box type and 1099 Box to the MISC values.

After you have made the entry save and continue your normal processes. The new 1099-NEC information will flow to the 1099’s normally.

Part 3 – Adjusting Historical Information

When upgrading from a prior version, MIP does not remap or change any 1099 historical information. Since most customer have been making payments for the first part of the year manual adjustments will be required to get the values out of the MISC-07 and into the NEC.

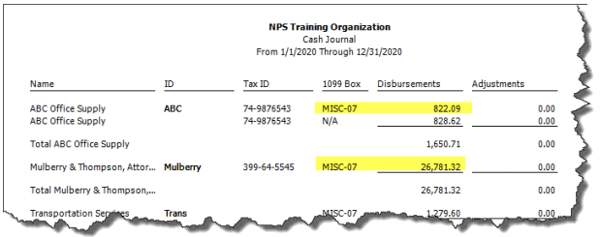

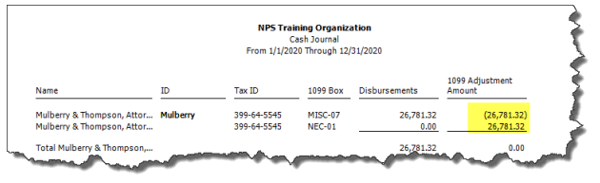

To find out what needs to be adjusted go to Reports>Journals>Cash Journal and select the <1099 Summarized Vendor Totals Report> and run it.

This gives a report that shows all the cash transactions for the year and if they were coded to a 1099 Box.

When looking at this report pay careful attention to the 1099 Box. It is possible to have the

same vendor with multiple 1099 Box types. You are only concerned about what goes to MISC07.

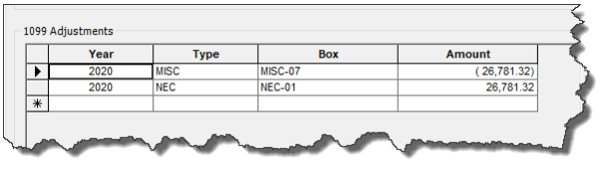

After you have determined which vendors need adjustment and by how much go to

Maintain>Vendors.

Pull up the vendor and go to the 1099 Information Tab.

In the 1099 Adjustment grid at the bottom you will put in an adjustment to MISC-07 for a Negative amount equal to the total coded to that box.

You will also put in a positive adjustment to NEC for the same amount.

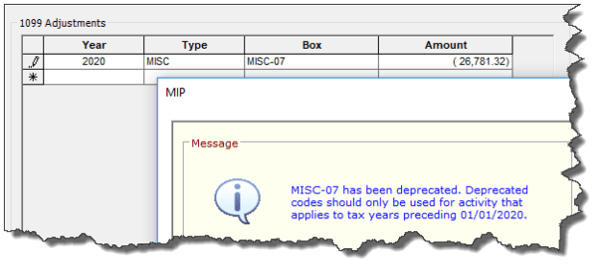

Note: When you do the negative adjustment or any adjustment to MISC-07 in the 2020 year you will get a warning message. This is to remind you that normally you would not adjust MISC07 in 2020. Ignore the warning and continue with your work.

After you have made the adjustments you can click save and move on to the next one.

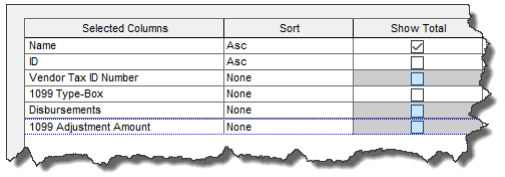

If you want to check your work, go back to the <1099 Summarized Vendor Totals Report>. Go to the content tab and modify the content to look like this.

Print the report and you will see the adjustments.

Q: I have a lot of vendors that need adjustment. Is there a way to automatically remap or adjust values for 2020?

A: There is no way to mass update the information through the user interface. You can contract with Soft Trac for Professional Data Services to change the values.