MIP TRICK OF THE MONTH

Correcting 1099 Data

There are typically two ways to correct an error once it is identified:

- Manually, in the Aatrix® 1099 Preparer Grid.

- Exiting Aatrix® and making the correction in the MIP Fund Accounting application. Start Aatrix® again.

Correcting the Error through Aatrix®

It is important to note that changes made directly on the grid will not update MIP Fund Accounting itself. If for any reason you need to exit Aatrix® and create new 1099's, any changes made directly in Aatrix® will be lost.

Consider if the corrections are important enough for your permanent MIP Fund Accounting data to be updated, because changes made into Aatrix® will not be reflected in MIP Fund Accounting.

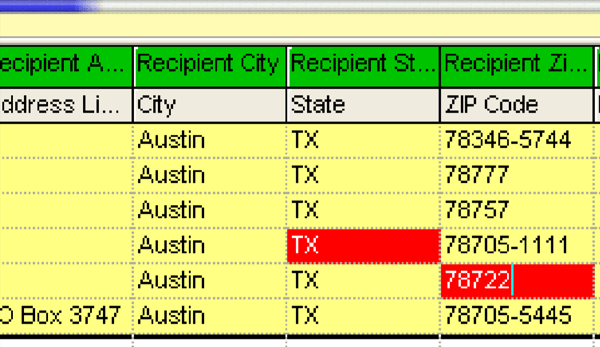

If you choose to make changes directly into the Aatrix®, you can simply correct the values directly on the Aatrix® Grid, replacing the old data with the correct values, as shown below.

After you have made the necessary correction(s) you can click <next> and move onto the next

validation step.

Correcting the Error through MIP Fund Accounting

- Exit out of the Aatrix® 1099 process without saving any changes.

- In MIP Fund Accounting, go to Maintain > Vendors and make applicable corrections.

- Restart the Aatrix® filing process.

- In the above example, the user would add state information to the Vendor record in MIP Fund accounting, restart the Aatrix® filing process, and the change made in MIP Fund Accounting would be present on the Grid.

Error Correction in MIP Fund Accounting

Where the error is the amount/value in one of the 1099 boxes, you can make an adjustment to that box number and amount on the Vendor 1099 Information Tab.

Go to Maintain > Vendors > 1099 Tab. In the bottom, put in the amount of the correction along with the year, form, and box number. This will correct the amount on your 1099 form, but it will not change any coding in your ledgers.

If the problem is deeper (e.g. miscoded transactions) you may wish to do JVs in accounting to correct both the 1099 amounts and your books. After making corrections and adjustments, restart the 1099 process. The changes made should be reflected in the grid.

The above instructions are an excerpt from the 2019 Aatrix® 1099 Filing Instructions. For more information on producing, printing, filing, and correcting 1099s, view the full 1099 Guide.